5 legal issues to consider before buying

Buying a home can sometimes feel overwhelming. Our property expert Jasmine Phayre has compiled a checklist of five legal complications to consider, to help make buying your home much simpler.

"At Laurus we pride ourselves with how we expertly guide our clients through what is typically the most expensive purchases of their life", Jasmine tells us. "If you’re looking to buy a home, we highly encourage an early conversation with our team about how our conveyancing services can help you."

1. Leasehold issues

If you’re looking to buy a flat or other leasehold property, it is important to look at the number of years remaining on the lease. The lease provides you with the ownership of the leasehold property for the remaining number of years in the lease, at the end of the lease the leasehold property (flat) reverts back to the Landlord.

It is sensible to consider a lease extension when a property has 90 years or less remaining on the lease, the shorter the amount of time remaining on the lease, the more expensive it is to extend.

It is important to ensure that you know how long there is left on the lease, and if this will affect the value of the property before you make an offer.

“A good solicitor will help you spot potential issues so you can solve them before they become a problem,” Jasmine says, “In the case of lease extensions, there are several ways for a buyer to arrange a lease extension as part of the buying process."

Two popular options include:

- Request the seller to contact the Landlord to request what we call an “informal lease extension”. This route starts open communication with the landlord about the possibility of them granting a lease extension. The landlord is not obligated to agree to a lease extension and the terms of the lease extension (ground rent and the premium) are open to negotiation.

- If the landlord does not agree to provide a lease extension or the terms of the lease extension are less favourable than a “statutory lease extension”, and the seller has been the registered proprietor of the property for more than 2 years, then the buyer can request that the seller assigns the benefit of a section 42 notice. This triggers the statutory lease extension process. Through this route the landlord is required to provide a lease extension of an additional 90 years and to reduce the ground rent to a peppercorn.

The best way to gain an idea of the cost of a lease extension is to obtain a lease extension survey.

For all routes the following costs will need to be taken into consideration when starting negotiations:

- Your own legal costs

- The legal costs of the landlord (very rarely negotiable)

- The lease extension survey costs

- The premium of the lease extension

The government are currently discussing plans to overhaul the lease extension process but it is not clear when these plans will come into effect. You can read more about lease extensions here.

2. Stamp duty costs

Last year’s stamp duty holiday accompanied an increase in activity in the market – first time buyers purchasing under £500,000.00 are the only category of buyer who currently have discounts on Stamp Duty Land Tax (“SDLT”), and are limited to SDLT not being charged on the first £300,000.00. Make sure you’re aware of how much SDLT you’ll have to pay, and whether you benefit from any discounts.

When calculating your SDLT you must take into consideration whether your own, or have a share in, any property around the world, as this will mean you will not benefit from first-time buyer relief (even if this is your first property in the UK). In addition, you are required to pay the higher rate of SDLT.

Further, if you are not considered a UK resident you are also liable for additional SDLT.

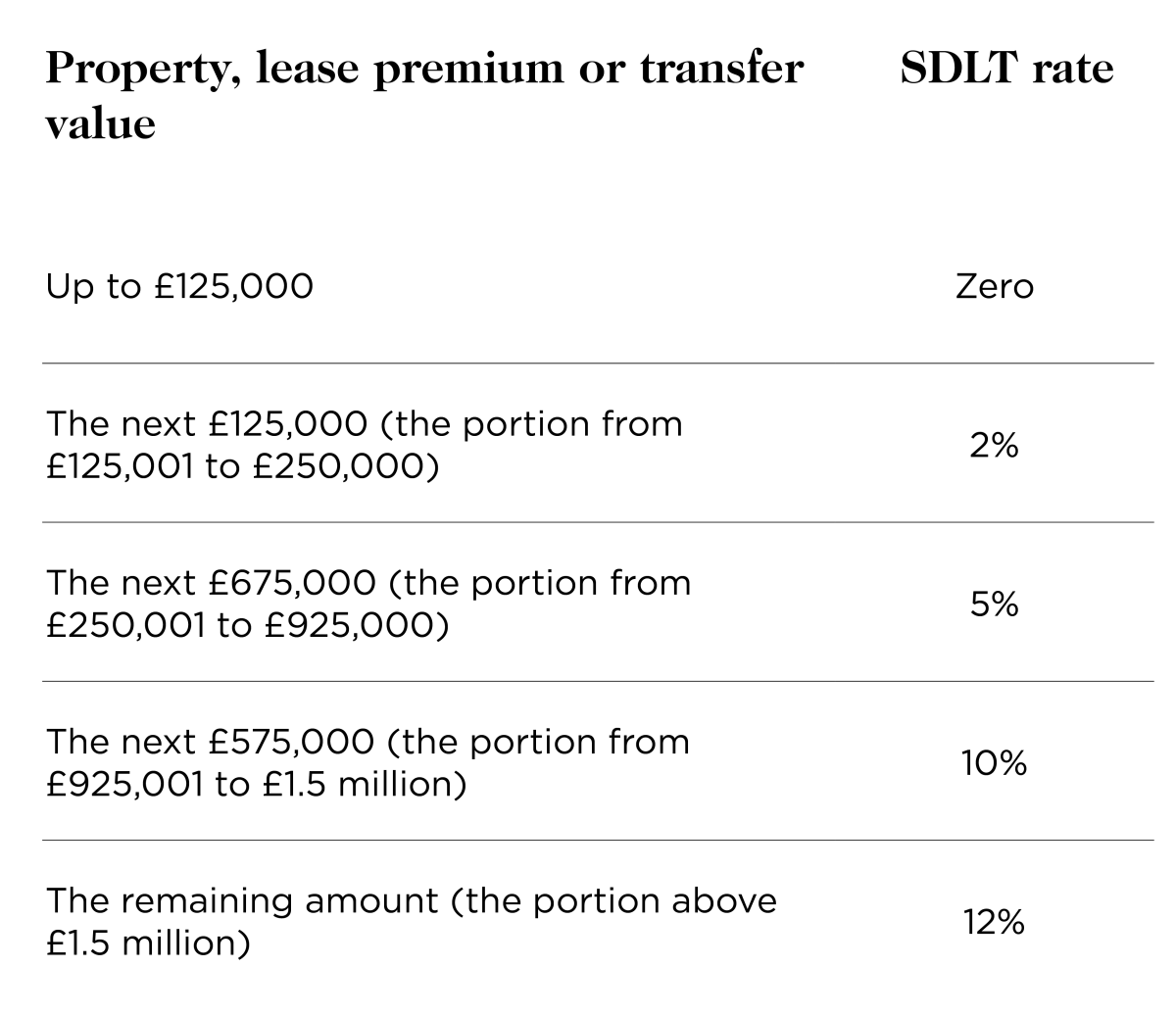

You are advised to always seek financial advice to ensure that you are aware of how your personal circumstances impact your SDLT liability. Here's a quick guide to the current SDLT bands:

3. What’s included?

Fixtures and fittings (e.g. furniture and appliances) - if you have negotiated that certain items of furniture are to be left at the property when you agree your offer (white goods for example), be sure to inform your solicitor and they can arrange for the contract to reflect the same. To avoid disappointment, don’t assume the seller will be leaving or taking certain appliances or fittings. The seller will complete a Fittings and Contents Form which specifies what will be removed and remain at the property on completion, please ensure that you review this document carefully and raise any concerns with your Solicitor prior to exchange.4. Living with someone

If you’re buying a property with someone else, consider how your finances will be tied up together in your property, and consider what should happen to the profits when you sell the property. For example, if you are not married and live with your partner/friend/relation and they own the property in their sole name, they can sell the property without your permission or being required to repay any funds you may have contributed to the property by way of bills or renovations.

Having agreements in place can prevent arguments, which can be in the form of a Declaration of Trust, Cohabitation Agreement, pre-nuptial and post-nuptial agreements.

“As well as covering the actual conveyancing process, a good solicitor will take all of your legal needs into consideration. At Laurus, we’re set up to help you reduce financial risks in other areas of your life too, which includes protecting your financial share of a property with a Declaration of Trust, for example.”

5. Get a will at the same time

It is important to ensure that your Will correctly reflects your financial position as purchasing a property is a huge investment and should be treated and protected as such. Further, having a Will in place provides great comfort to you and your loved ones should the worst happen. During the conveyancing process you are introduced to our Legacy team who are happy to arrange a free consultation to address how they can best assist and plan with you.